The 25-Second Trick For Mortgage Broker Salary

Wiki Article

4 Simple Techniques For Mortgage Broker Vs Loan Officer

Table of Contents9 Simple Techniques For Broker Mortgage MeaningThe Buzz on Broker Mortgage MeaningWhat Does Mortgage Broker Assistant Job Description Do?The 30-Second Trick For Mortgage Broker Job DescriptionThe 3-Minute Rule for Broker Mortgage FeesThe Facts About Mortgage Broker Assistant RevealedThe Ultimate Guide To Mortgage Broker Average SalaryRumored Buzz on Mortgage Broker

What Is a Home mortgage Broker? The home loan broker will certainly work with both events to get the specific accepted for the lending.A mortgage broker commonly works with numerous different lenders and can provide a range of lending choices to the debtor they work with. The broker will certainly accumulate info from the private and also go to numerous lenders in order to find the ideal possible loan for their customer.

Mortgage Broker Average Salary Fundamentals Explained

All-time Low Line: Do I Need A Mortgage Broker? Dealing with a home mortgage broker can save the customer effort and time throughout the application process, and possibly a great deal of money over the life of the funding. Furthermore, some loan providers work solely with home mortgage brokers, indicating that customers would have accessibility to financings that would certainly or else not be readily available to them.It's crucial to analyze all the costs, both those you could need to pay the broker, as well as any type of costs the broker can aid you prevent, when evaluating the decision to collaborate with a mortgage broker.

9 Easy Facts About Broker Mortgage Near Me Explained

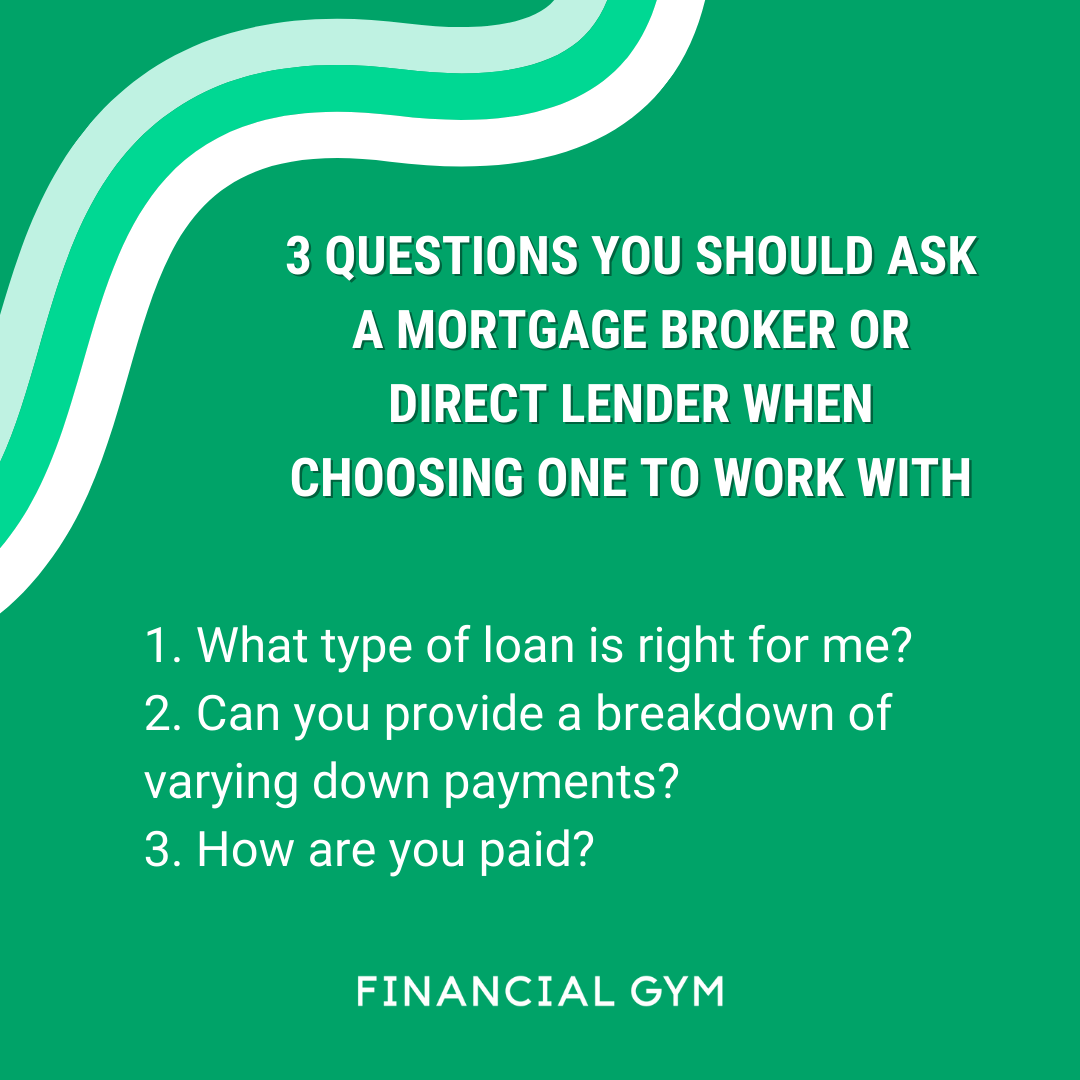

You've most likely listened to the term "home loan broker" from your property agent or good friends who've acquired a house. What precisely is a home mortgage broker and also what does one do that's different from, claim, a financing policeman at a bank? Nerd, Wallet Guide to COVID-19Get solutions to concerns about your home loan, travel, finances and keeping your comfort.1. What is a home loan broker? A home loan broker acts as an intermediary between you and prospective lenders. The broker's task is to contrast home loan lenders on your part as well as find rates of interest that fit your needs - mortgage broker assistant job description. Home mortgage brokers have stables of lending institutions they collaborate with, which can make your life easier.

What Does Mortgage Broker Job Description Do?

Just how does a mortgage broker obtain paid? Mortgage brokers are most typically paid by loan providers, in some cases by debtors, however, by law, never ever both.The competitiveness and residence rates in your market will certainly contribute to determining what home loan brokers cost. Federal legislation restricts how high payment can go. 3. What makes mortgage brokers different from lending police officers? Lending police officers are employees of one lender that are paid established salaries (plus benefits). Financing policemans can create only the sorts of loans their employer selects to supply.

How Mortgage Broker Assistant can Save You Time, Stress, and Money.

Mortgage brokers might be able to provide borrowers access to a wide selection of funding kinds. You can conserve time by utilizing a home mortgage broker; it can take hours to apply for preapproval with different lending institutions, after that there's the back-and-forth communication entailed in financing the car loan and making certain the purchase stays on track.When selecting any type of loan provider whether via a broker or straight you'll desire to pay focus to lending institution costs." Then, take the Finance Price quote you get from each lender, place them side by side as well as compare your rate of interest price and also all of the fees and closing expenses.

The Single Strategy To Use For Mortgage Broker Assistant

5. Exactly how do I select a home mortgage broker? The very best way is to ask friends click here for more info and also loved ones for recommendations, yet ensure they have in fact utilized the broker and aren't simply going down the name of a previous university flatmate or a remote associate. Discover all you can concerning the broker's solutions, click here now communication style, level of expertise and technique to clients.

Not known Incorrect Statements About Mortgage Broker Association

Competition and home prices will certainly affect how much home mortgage brokers earn money. What's the difference in between a mortgage broker and also a car loan policeman? Home loan brokers will certainly deal with lots of lenders to find the ideal car loan for your scenario. Finance policemans help one lending institution. Exactly how do I discover a home loan broker? The very best way to find a home loan broker is through recommendations from family members, good friends and your realty agent.

About Mortgage Broker Assistant

Acquiring a brand-new residence is one of the most mortgage broker hull complex occasions in a person's life. Feature differ greatly in terms of design, features, school area and also, certainly, the always essential "place, location, area." The mortgage application process is a complex facet of the homebuying procedure, especially for those without past experience.

Can determine which concerns might produce difficulties with one loan provider versus another. Why some buyers stay clear of home loan brokers Occasionally homebuyers really feel a lot more comfy going directly to a huge financial institution to secure their car loan. In that case, purchasers ought to at the very least talk with a broker in order to comprehend all of their options pertaining to the kind of financing and also the offered rate.

Report this wiki page